Red teaming in regulated environments has become essential for organisations facing sophisticated cyber threats. While traditional penetration tests provide value, red teaming goes further – simulating realistic adversary behaviour to test defences under real-world conditions. For UK financial services, this approach has evolved from optional to mandatory through frameworks like CBEST and STAR-FS.

How regulator-led testing fortifies market stability and sets a national standard

Cyber threats are constantly evolving, with organizations facing sophisticated and persistent campaigns orchestrated by well-resourced adversaries.

To truly understand their readiness against these determined attackers, organizations must enhance traditional penetration tests with threat-led assessments. To gain insight into their overall preparedness against a determined attacker, organizations need to complement traditional penetration tests with threat-led assessments.

UK financial services regulators have recognized that serious incidents at systemically important institutions can jeopardize financial stability and inflict significant harm on consumers. Imagine customers unable to access their funds, make payments, or receive essential services. This reality highlights a critical gap: traditional assessments are often insufficient in providing the meaningful assurance needed to combat today’s modern adversaries.

A critical cog in the regulatory machinery

Threat-led penetration testing goes beyond traditional penetration testing; it’s a cornerstone of the regulatory framework for UK financial services.

Through CBEST and STAR-FS assessments, regulators like the PRA and FCA gain actionable, evidence-based insights into a firm’s resilience by simulating realistic cyberattacks on live, operational systems.

The findings from these assessments play a critical role in shaping regulators’ understanding of a firm’s cyber resilience. They provide tangible assurance that significant risks are being identified and effectively managed. This transforms the testing from a technical exercise into a feedback loop for robust regulatory governance.

A contribution to the greater societal good

While these testing frameworks deliver clear benefits to the firms involved, their primary purpose extends beyond the in-scope firm to the protection of the wider economy. It’s crucial to understand that a significant cyber disruption at a major financial institution could put our financial stability at risk. That’s why frameworks like CBEST were developed.

By mimicking the actions of genuine adversaries to test the defenses protecting key business functions, these exercises improve the resilience not only of the individual firm but, by extension, that of the entire financial system.

Adopting advanced, intelligence-led testing frameworks should not be viewed as a regulatory burden but as a sign of a sector’s maturing approach to risk.

The genesis of CBEST marked a fundamental shift away from a reactive, compliance-focused security posture towards one that proactively anticipates, withstands and absorbs the impact of severe but plausible cyber-attacks. This isn’t an adversarial process; it’s about building a collaborative environment. The framework encourages trust and shared purpose among firms, regulators, and accredited testing providers.

The subsequent introduction of the STAR-FS framework to the UK financial services market establishes afirm-initiated assessment to demonstrate their maturity to supervisors, which in turn encourages a market-wide uplift in resilience.

Conclusion

By moving beyond theoretical compliance and practically assessing defenses against realistic cyberattacks, frameworks like CBEST and STAR-FS provide critical insights into the genuine risk posture of financial institutions.

These frameworks not only strengthen individual firms but also contribute to the stability of the wider financial system by sharing anonymized findings and establishing good practices.

Looking forward, the onus is now on firms to act proactively. Commissioning a firm-led STAR-FS assessment allows organizations to prepare not just for future compliance but for a new reality where resilience is paramount.

Demonstrating resilience through sophisticated testing is no longer just a marker of good practice; it has become a fundamental expectation of regulators, investors, and customers alike. In an increasingly hostile environment, this capability is a prerequisite for strategic advantage and long-term success.

Jayson E Street Joins CovertSwarm

The man who accidentally robbed the wrong bank in Beirut is now part of the Swarm. Jayson E Street joins as Swarm Fellow to help us…

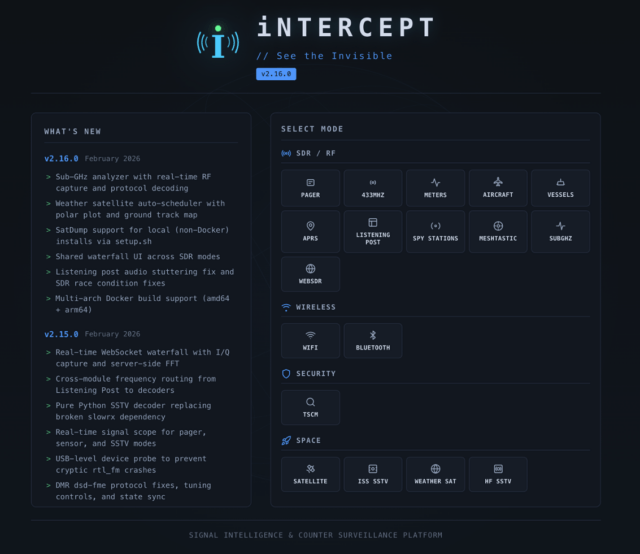

iNTERCEPT – How A Small RF Experiment Turned Into A Community SIGINT Platform

I’ve always been fascinated by RF. There’s something about the fact that it’s invisible, the fact that you might be able to hear aircraft passing overhead…

When Your IDE Becomes An Insider: Testing Agentic Dev Tools Against Indirect Prompt Injection

Agentic development tools don’t need to bypass your firewall. They’re already inside. And if an attacker can control what they read, they can control what they…